Safeguarding Your Accounting Firm: A Guide to Business Continuity and Disaster Recovery

In the meticulously detailed world of accounting, the sudden loss of data or an unexpected disruption can be nothing short of catastrophic. From natural calamities to cyber threats, the unexpected lurks around every corner. How can accounting firms prepare and protect themselves? The answer lies in a robust Business Continuity Plan (BCP) and a fail-safe Disaster Recovery (DR) strategy.

Why BCP & DR are Crucial for Accounting Firms

- Data Integrity: Accounting thrives on accuracy. A loss of crucial financial data can have legal and reputational ramifications.

- Client Trust: Clients entrust you with their most sensitive information. Any breach or loss can erode that trust.

- Compliance Requirements: Accounting firms must adhere to stringent regulations like SOX and GAAP. A robust BCP & DR strategy ensures compliance.

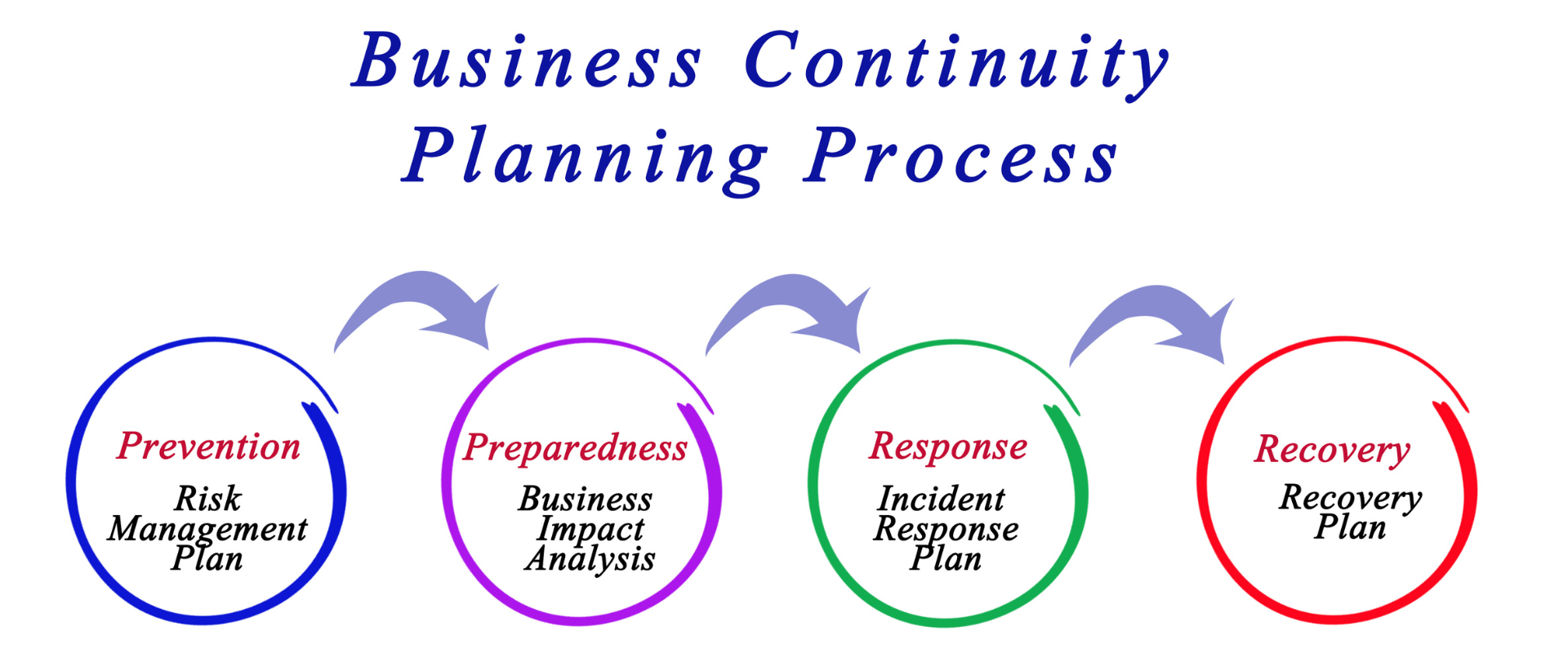

How to Build a Resilient BCP & DR Plan for Your Accounting Firm

- Identify Critical Operations: Pinpoint the essential functions that must continue unabated. These could include payroll processing, tax filings, or audit functions.

- Set Clear Recovery Goals: Establish realistic Recovery Time Objectives (RTO) and Recovery Point Objectives (RPO) specific to accounting needs.

- Embrace Industry-Specific Solutions: Opt for cloud services and software tailored for the accounting industry, ensuring that unique requirements are met.

- Test and Update Regularly: Regular drills to simulate potential disasters keep your plan agile and effective.

A Lesson from the Field

Consider the case of a mid-sized accounting firm hit by ransomware. They had a robust DR plan that allowed them to restore their encrypted data from a secure backup. Simultaneously, their BCP ensured that client communications and essential functions continued from an alternate location. The result was a seamless response, minimal downtime, and undamaged client relationships.

Conclusion

In the nuanced world of accounting, where precision is paramount, a robust BCP & DR plan isn’t just an afterthought; it’s an essential line of defense.

“The only thing harder than planning for an emergency is explaining why you didn’t.” This quote aptly emphasizes the importance of being prepared.

Your accounting firm’s resilience in the face of adversity isn’t merely about recovery; it’s about maintaining the integrity, trust, and excellence that define your profession. Invest in a comprehensive Business Continuity and Disaster Recovery strategy today, and safeguard your firm’s future.

For specialized assistance tailored to the accounting industry’s unique demands, reach out to us. We’re here to help you build a fortress around your business.